🚀Staking Modules

Modules are places where users can stake their tokens to get rewards. As of now, we have two available modules, each designed to distribute performance fees among participants. We expect to add more modules with different features in the future.

Performances fees distribution

Every Tuesday, we collect all the protocol fees from the previous week and distribute them to all the investors who have decided to allocate their xPRY to the Dividends plugin.

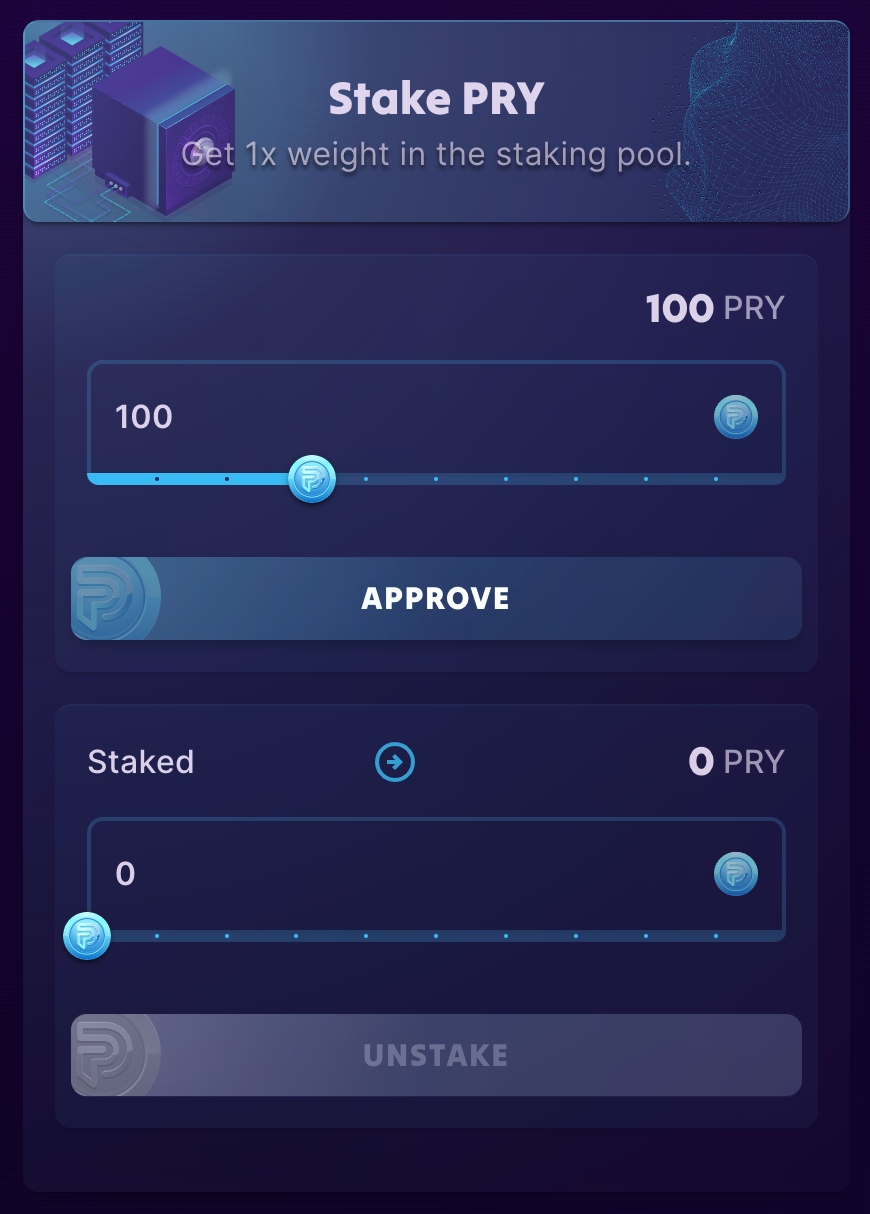

Liquid Staking Module with $PRY tokens

This first module is intended for PRY token holders who do not want to convert them into xPRY. The result is a "liquid" module as the owner can deposit and withdraw their PRY tokens easily.

Protocol fees multiplier: 1x

0.5% fee when unstaking which are burned

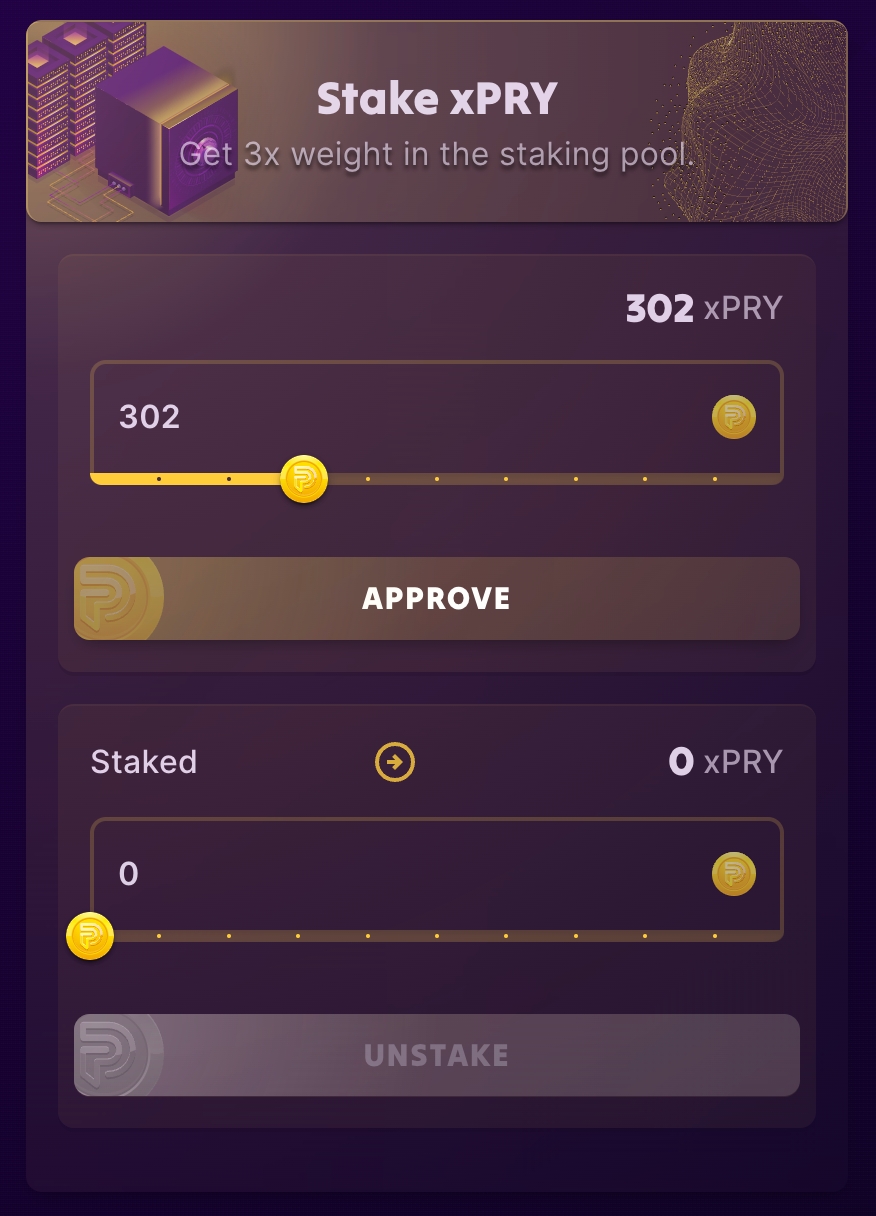

Locked Staking Module with xPRY tokens

This second module involves having xPRY tokens in your possession (read # if you don't know what it is). Owning xPRY is more restrictive because the owner is not "liquid," but in return, they receive many more benefits. This module is suitable for long-term users:

Protocol fees multiplier: 3x when staked

No unstaking fee

Distribution Scheme

Protocol fees are collected each time a vault manager closes a profitable trade. These collected fees are used to buy back $PRY, which is the primary and only token distributed to the staking modules (Liquid and Locked). Why distribute $PRY? As we are establishing our legal structure, regulatory compliance is crucial for the long-term health of Perpy.

How are the protocol fees distributed?

Each week, the protocol fees generated from the previous week are distributed to the 2 modules

Assuming that fees generated during the week, allocated to stakers, amount to $1,000. The "Liquid" module will receive $250, and the "Locked" module will receive $750. These amounts will be distributed among the stakers in each module. For instance, if there are 8 stakers in the "Locked" module, they will share the $750 proportionally based on the number of xPRY tokens they have staked.

Last updated